Budget Planning and Balancing Your Money

Firstly, budget planning and balancing your money are great habits to get into. It’s

At the moment, more people are finding their outgoings are more than their income. Therefore, are needing to squeeze more out of their money and keep an eye on their money more than ever.

We know from personal experience how difficult this can be. At that moment, you realise you don’t have enough money to pay everything and you literally have to watch every penny and pound.

How to start Budget Planning

At the beginning, it may feel like a bit of a task but having the right tools and information, will make it easy. Before long, you’ll be in the habit of checking your budget regularly. Ideally, you will want to do this once a month. All of a sudden, you should soon notice you have more control over your finances.

At first, think about the best planner for you.

You can get some really nice planners out there on the market but some can be on the expensive side or they might not work well for your circumstances.

Some apps want you to have a subscription or pay for extra features.

In our family, there’s 2 adults and 7 kids in total. Consequently, I often find it hard to get a planner which I can fit all of the family stuff on. Therefore, I usually make my own. I like that I can m

Digital / Online

At the beginning, it may feel like a bit of a task but having the right tools and information will make it easy. Before long, you’ll get into the habit of doing this regularly, ideally once a month and you should notice you have more control of your finances.

At first, think about the budget planner for you. There’s some really nice ones on the market but they can be a bit on the expensive side or they may not work well for you. Some apps want you have a subscription or pay for extra features. Having such a large family I often find it hard to get a planner with enough space for everything.

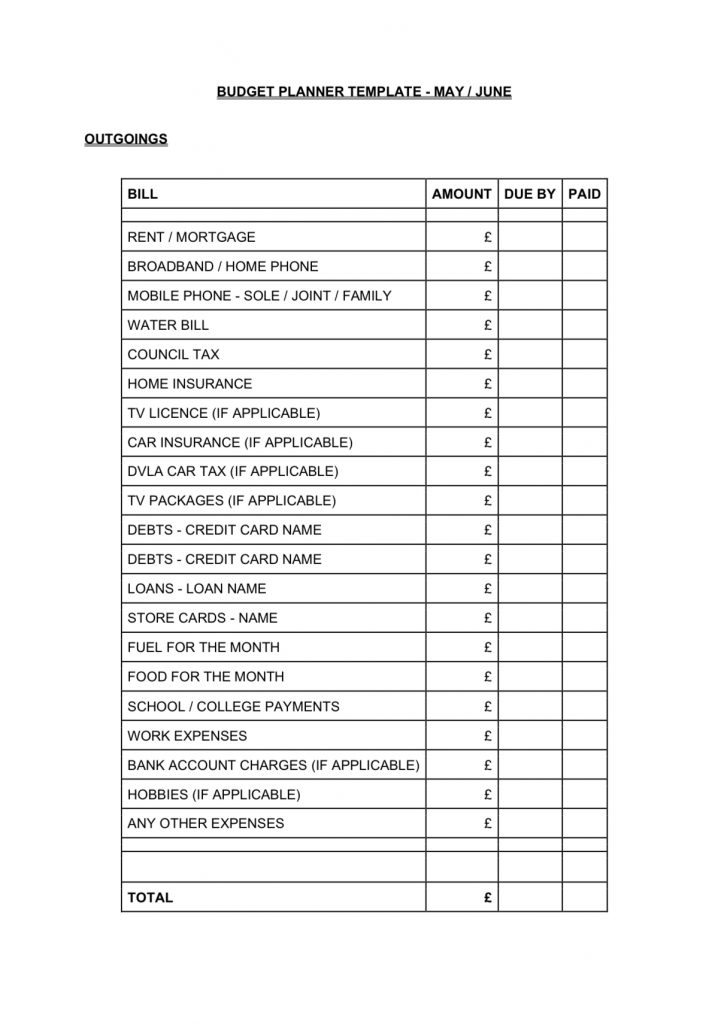

Digital or online planners are handy. You can check your budget when out and about. You can make one using word, excel or google docs etc. I have a budget planner template on our Money Savers Club facebook group.

Click the link below to check it out.

Traditional Budget Planner

If you prefer a more traditional style planner, you can make your own with a plan A4 notepad.

You can pick one of these up quite cheap. I usually purchase mine from The Works, the range or B&M but have also picked up some nice ones from local supermarkets and pound shops. Depending on how fancy you want to make it, all you need is a ruler, pencil, pens and a highlighter / pencil / crayon if you want.

Secondly, you will need all the information to hand when you first start budget planning. When it comes to your income, always work on the income which you know will be

Balancing Your Money

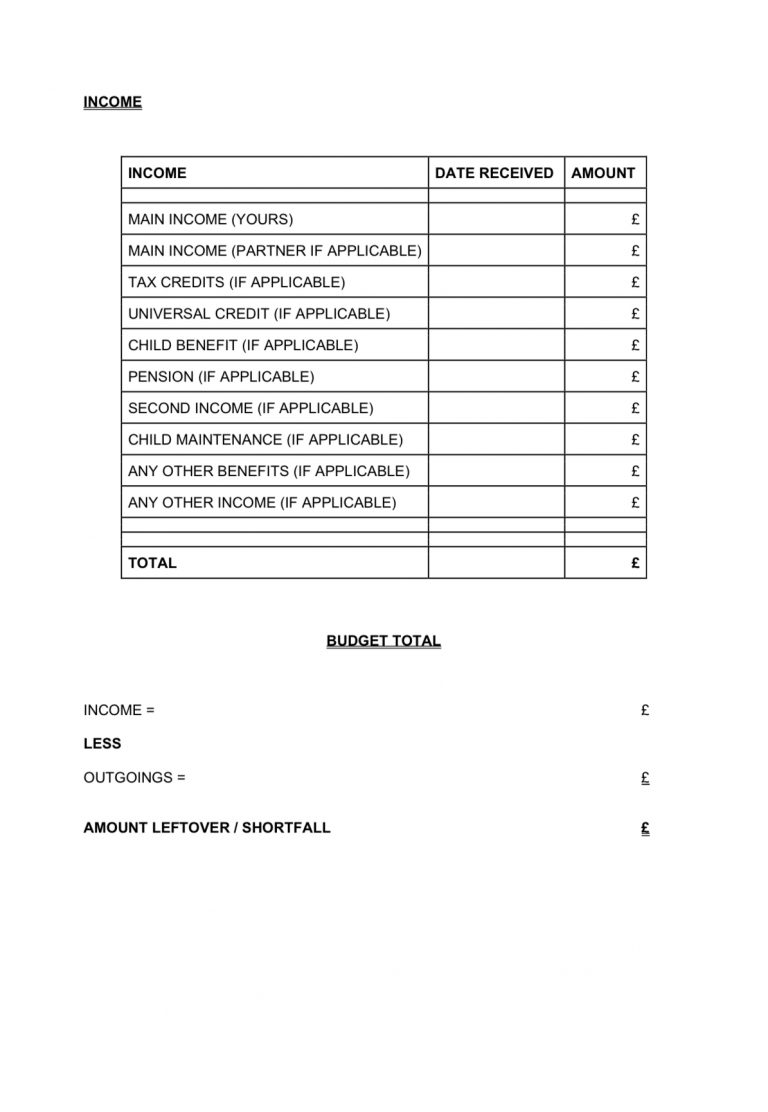

At the beginning, it will help to have all the information to hand to work out your income and outgoings.

Firstly, you will want to have details of all the money you know you will receive each month. For example, your wages from employment or guaranteed benefits.

If you are self employed, depending on how you get paid, you may have to use the last months figures or update your income more. If you’re unsure it’s always better to slightly underestimate your income and slightly overestimate your outgoings. It’s always better to find out you’ve got more money left over than you were expecting than have less.

Secondly, you want to work out all your essential bills you pay each month. For example, your rent / mortage, council tax and utility bills.

Next, you will want to look at what debts you need to pay each month, memberships and subscriptions. Then you will want to add your travel expenses to work or school and groceries.

By the end, you should find yourself with two figures and it should look something like this.

Simple Budget Planning Record

Going through your budget sheet and knowing what money you have left to play with, or not, each month will really help you get a grip of your finances.

Often, you can find it quite suprising. There can often be more money spare than you would initially think.

If you’ve got spare money at the end of the month, it’s good to split it 3 ways.

Savings,

Paying off a bit of extra debt / bill; and

Treat Money for yourself.

I tend to use a 25% – 25% – 50% usually with the 50% being for savings or paying off extra debt or a bill. If you don’t have a lot left, focus on the debt and savings.

What to do if you have a shortfall after budget planning

You may find yourself in the situation where there’s a shortfall. You may not have enough regular or guaranteed money coming in, to pay everything you need.

Whilst at first glace, it’s quite alarming, again we speak from experience, it’s not always as negative as you would think.

You have the tools to go through every detail of your income and expenses. This should help you discover areas where you can reduce your outgoings or increase your income.

For example, if you pay for a gym membership you may have to cancel it or put it on hold. Are there any bills which you can reduce (we obviously can help with reducing your utilities or earning an extra income).

Calling the companies and being honest about your circumstances can help. Any debt company will want to go through your income and expenses so this is where your budget planner will be handy again. I’ll be doing a whole blog on this next week.

You may choose to bring more money into your home with overtime, taking on a second job or work from home opportunity. Selling unwanted items on Facebook Market, Vinted, carboots, eBay etc can bring in extra cash. A busy carboot on a nice day can be very worthwhile sometimes. One man’s junk is often another man’s treasure.